THERE seems to be more winners than losers in Dorset following Chancellor George Osborne’s Budget.

Local people have given their reaction following what Mr Osborne billed as ‘a Budget for our aspiration nation.’ Those with more children and those who use childcare a lot will benefit most from childcare tax breaks worth as much as up to £1,200 per child.

This will apply to couples where both parents are working or single parents who are employed.

In a bid to stimulate growth, Mr Osborne has announced new plans to help people buy their own homes.

Potential homeowners will need a deposit of just five per cent for a new house because they can qualify for shared equity interest-free loans towards mortgages under a Help to Buy scheme.

The amount people can earn tax free before basic-rate income tax kicks in will be raised from £9,440 to £10,000 from April next year.

But higher-rate taxpayers will also benefit from the Budget, with the 40 per cent income tax rate kicking in at a lower rate of £41,450 next year – a fall from £42,475 for this tax year.

There was some good news for drinkers and motorists – with the planned 3p rise in beer duty scrapped and replaced by a 1p duty cut on a pint of beer.

A 3p rise in fuel duty for September was waived.

The Chancellor said petrol and diesel will be 13p per litre cheaper than it would have been if the 'escalator' which puts fuel duty up had been enforced over the past two years.

Wine drinkers were considered to be among the losers of the Budget though, with the 'escalator' which raises duty on alcohol by a minimum of inflation plus two per cent, kept on wine.

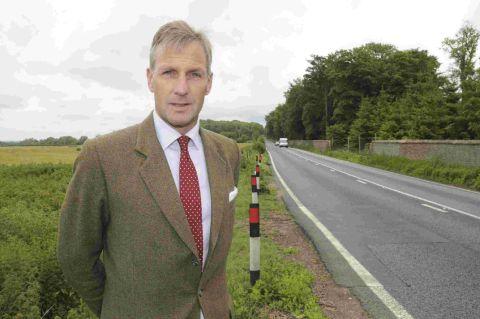

South Dorset MP Richard Drax, inset, welcomed the budget and said it would encourage business.

He welcomed the decrease in corporation tax, and said he was delighted that that beer duty had been cut and fuel duty had been frozen.

He said: “I’m delighted that the personal allowance will increase to £10,000. It’s pretty substantial.”

But he said he was concerned that the government was still borrowing vast sums of money and government expenditure should be cut.

Picket lines were manned nationally to coincide with the budget.

People went out on the picket line at Weymouth Job Centre yesterday morning.

Branch chairman for the PCS Tim Nicholls said it was part of a national strike and that about 50 per cent of the PCS members went out in Weymouth. He said: “This is an ongoing programme of action.”

The protesters wanted to highlight issues including conditions, services and pensions.

Poverty protests

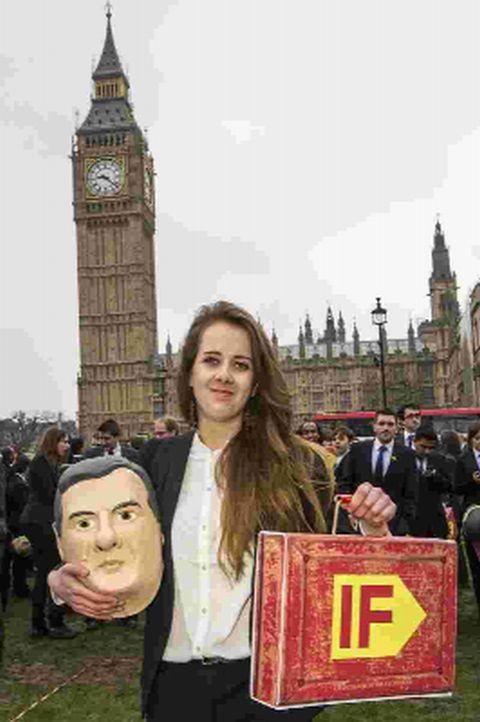

Campaigner Kristie Thacker joined 499 other people dressed as the chancellor to make her point about helping impoverished people across the globe.

The 19-year-old, who is studying geography at Nottingham University, and is from near Abbotsbury appeared outside the Houses of Parliament earlier this week dressed in a suit and a George Osborne mask carrying an ‘IF’ branded budget box.

She and fellow campaigners were calling for world leaders to tackle the root causes of hunger, including international aid and tax as part of Oxfam’s IF campaign.

Kristie, who studied at the Sir John Colfox School in Bridport, said: “I think we have a responsibility as one of the most developed countries in the world to people who are in a worse situation than we are.”

See enoughfoodif.org for more information.

The small business owner

CHRIS Reay, owner of Cafe Weymouth and the Channel Guest House in Weymouth welcomed news that corporation tax will be cut by one per cent to 20 per cent in 2015.

Mr Reay said: “There’s some good news for us. In terms of the economy it’s a shame there’s still large firms who haven’t been paying their fair share in tax.

“As a small business you can't help feeling a bit hard done by as these people have got huge revenues to employ tax lawyers who can get them through the loopholes.

“We’re a small family set-up and we run our business by the book.”

The taxi firm

MANDY Fry, manager at Weyline Taxis, said she welcomed September's planned 3p rise in fuel duty being scrapped.

She said: “In this industry we welcome them not putting up petrol an extra 3p. This will enable us to keep any future tariff increases to a minimum.

“Motorists always seem to be the hardest hit when it comes to budget day so it’s nice to see this.

“We find that we spend £90 to £100 a week on petrol for each car. We also have to pay a lot for our insurance premiums because taxi drivers are considered a high risk.

“Unfortunately we can’t be more fuel efficient and have smaller cars because our vehicles have to be a certain width.”

The job seeker

UNEMPLOYED Terence Bowering welcomed the news that 600,000 more jobs are expected this year.

The claimant count is expected to fall by 60,000, the Chancellor has announced.

Mr Bowering has been looking for full-time work since he finished a temporary job in February.

He has been looking for a permanent job for more than a year.

“There needs to be more jobs made available and more investment that will create jobs.

“But it all depends on what they’re going to pay you,” he said.

Mr Bowering, of Puddletown, said a lot needs to be done in this area.

The publican

Christian Neagu runs the John Gregory pub in Southill, with his wife Beatrice.

He said the budget would make a ‘difference but not a huge one.’ Duty on alcohol will not be scrapped but a beer escalator will be, preventing a 3p rise this year.

Beer duty will also be cut by 1p from Sunday evening.

The escalator which raises duty on alcohol by a minimum of inflation plus 2per cent will be kept on wine.

Mr Neagu said: “To be honest with you we are doing ok now. I don’t know what will happen in the future.

“I don’t think 1p or 2p will affect the business.”

The pensioner

People in their 50s will benefit from the single flat-rate pension of £144 a week being brought forward to 2016.

Pensioner John Wilson, 82, lives with his wife Betty, 79, in Southill, Weymouth, said he had been watching the speech and felt pensioners had little representation.

Mr Wilson receives a state pension. He said: “I can’t see anything in this budget that’s changed. We are just the same as we were before.”

Mr Wilson said he was concerned about the ‘Granny tax’ that will come into effect in April. The tax is a change in age-related personal allowances - the amount of income that is tax-free.

The family

A Portland family have welcomed the budget.

Jemma King, 24, is a stay at home mum, her partner Matthew Barnes, 30, works full-time and they have a little boy of four, Jayden. The family, who are currently renting a property, said the new government plans to help people get on the property ladder could help them.

Miss King said she would like to go out to work but currently due to the cost of childcare it was more beneficial for her to be a stay at home mum.

She said: “Help with childcare would help a lot.”

The increase in the threshold for Mr Barnes’s personal tax allowance to £10,000 could also positively affect the family.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel