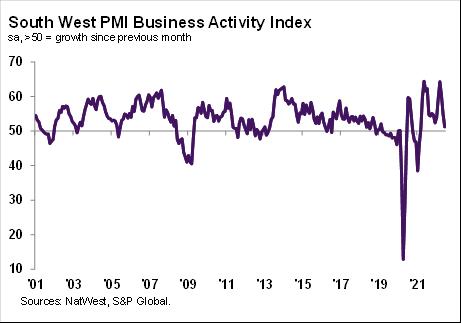

BUSINESS confidence is at its lowest level since the early days of the pandemic, while activity has risen at its slowest rate since March 2021, research reveals.

The latest NatWest PMI (Purchasing Managers Index) data for the South West shows only a marginal expansion in new orders, with the cost of living crisis and uncertain economic outlook making clients more hesitant to spend.

Business confidence was at its lowest since April 2020.

Paul Edwards, chair of NatWest South West Regional Board, said: “The latest NatWest PMI data highlighted a further marked slowdown in business activity growth across the South West, suggesting that the performance of the sector over Q2 has been far less robust than that seen in the opening quarter of 2022.

“The current cost of living crisis, which is pushing up expenses for both companies and households, weighed heavily on expectations for the year ahead, which hit their lowest in over two years. Combined with rising interest rates and a slowdown in economic activity, this could dampen new business and output further in the months ahead."

The headline NatWest South West Business Activity Index – a seasonally adjusted measure of the monthly change output in the manufacturing and service sectors – fell from 55 in May to 51.2 in June. The rate of growth was the slowest for 15 months and weaker than the UK average.

New orders have been increasing for 16 consecutive months, but the rate of growth was the slowest over that period.

Optimism weakened to its lowest for 26 months and below the UK average. Businesses cited signs of an economic slowdown, high interest rates, rising costs and strained supply chains.

Staffing levels increased for the 16th consecutive month, but at the softest rate since November. While some firms had taken on extra staff due to rising requirements, others commented on difficulties filling vacancies and replacing leavers.

The seasonally adjusted Outstanding Business Index was above the neutral 50 mark, signalling a sustained rise in backlogs of work. There were reports that staff and material shortages had affected firms’ abilities to process and complete orders.

Average cost burdens continued to rise rapidly. The rate of inflation eased only slightly from May and was the third-sharpest on record since January 1997. The rate of increase remained slightly softer than that seen across the UK as a whole, however.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here