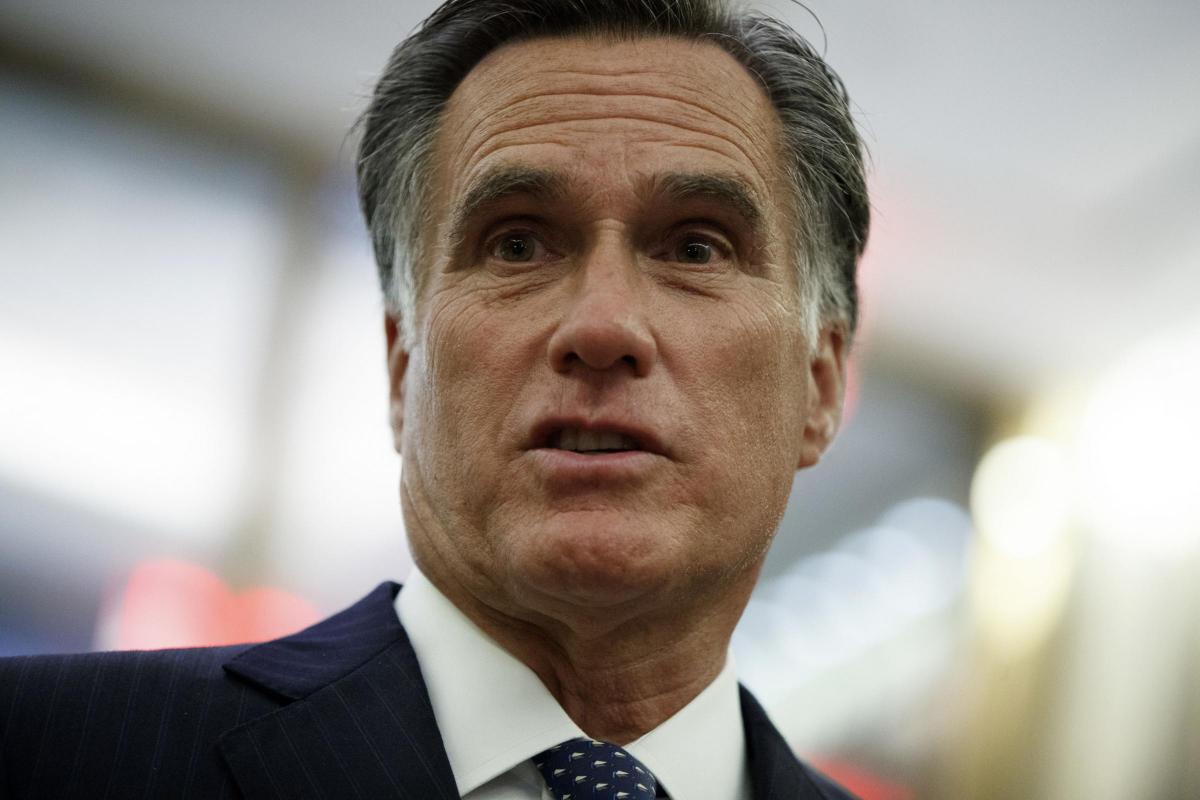

THE big Dorset employer LV= is set to be sold for £530million to an American private equity firm co-founded by former presidential candidate Mitt Romney.

LV= says the sale of its savings, retirement and protection business to Bain Capital next year will mean “unrivalled” commitment to the company and its people.

The chairman of the Personal Finance Society locally said he hoped the new owners would back an “amazing local business”.

LV= had already sold its general insurance arm to Allianz, with the two businesses coexisting at its County Gates headquarters.

LV= being sold for to Bain Capital for £530m

Alan Cook, chairman of LV=, said: “As a newly standalone life and pensions business in an increasingly competitive market, the board recognised that LV= required significant long-term investment to be sustainable.

“This transaction is the culmination of an extremely thorough and robust strategic review – followed by a structured sale process to secure the best long-term future for our members, employees, other stakeholders and the business.

“The board is delighted to have secured an attractive price and unanimously agreed that the transaction with Bain Capital presents an excellent financial outcome for all our members, as well as offering an unrivalled commitment to LV=’s future prospects, business and people.”

LV= completes £1billion sale of its general insurance business to Allianz

LV=’s chief executive, Mark Hartigan, said: “The partnership with Bain Capital recognises the opportunity to further invest to develop LV= at a time when it is well positioned, growing market share, expanding its products and trading resiliently, despite the pandemic. While our corporate structure will change, our culture and values remain the same.

“The board is excited by the opportunities it creates for our people, partners and customers - enabling the LV= brand and business to further develop as a major force in the UK life insurance market. “

Bain Capital is a Boston-headquartered private equity firm whose founders in 1984 included Mitt Romney, now a Republican senator who ran against Barack Obama for the presidency in 2012.

Kevin Forbes, chairman of the Personal Finance Society’s Hampshire and Dorset region and partner in Strategic Solutions in Poole, said: “After a run of de-mutualisations in the 1990s and noughties, LV has decided to follow that well-trodden route. Subject to members of the society agreeing, it looks like LV= will abandon its roots and join the masses that very regularly did the same starting with Abbey National in 1989.”

He said he would be interested to see how much of the £530m – and the £1billion sale of the insurance business to Allianz – would be returned to members, and how staff would be treated.

“LV= being a large local employer, we all have friends or family who must be upset by this news – firms always seem to do this thing around Christmas,” he said.

“I’m guessing the deal will involve at least some short term security of jobs.

“Let’s hope Bain Capital, who according to their website ‘strive to create value’ , back this amazing local business, with its amazing people working in it and develop it rather than strip it bare and flog it off for a profit.”

LV=’s with-profits policies will be ring fenced in a separate fund and closed to new business. The amount of capital available for distribution is expected to increase by up to 40 per cent, which will be used to increase payments to members as their policies mature.

The deal is subject to regulatory approval and backing from LV members. It is expected to be complete by the end of 2021.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel