THEY are two airports, 30 miles apart, with catchment areas that overlap.

Both have ambitious plans to attract more passengers – but is there room for both Bournemouth and Southampton to thrive?

Southampton Airport has published a “master plan” which it says could enable its annual passenger numbers to grow from two million last year to four million in 2027 and five million a decade after that.

Central to this aspiration is a 170-metre extension to its runway, which would enable it to reach the kind of European destinations that Bournemouth can currently serve.

Meanwhile, Rigby Group PLC – whose subsidiary Regional & City Airports (RCA) bought Bournemouth Airport last December – has revealed to the Daily Echo that it aims to double passenger numbers to around 1.5million in the next five years.

Derek Robins, senior lecturer in transport and tourism at Bournemouth University, said: “There’s always going to be scope for both to succeed.”

Southampton, he believes, will remain the bigger for several reasons, starting with the fact that it has a larger population within 90 minutes’ travelling time of the airport.

“Secondly, it’s that much closer to London so it works as a proxy airport for London,” he added.

“Thirdly, its really big advantage is that it has excellent public transport links, particularly rail links. It’s been quoted as being the shortest platform-to-runway airport in Europe.”

Bournemouth Airport can be frustrating to get to, despite current work to improve the road links including the Blackwater Junction on the A338.

“Bournemouth has an accessibility problem. It hasn’t got very good public transport,” Mr Robins said.

“Southampton’s always going to have an advantage in that respect.”

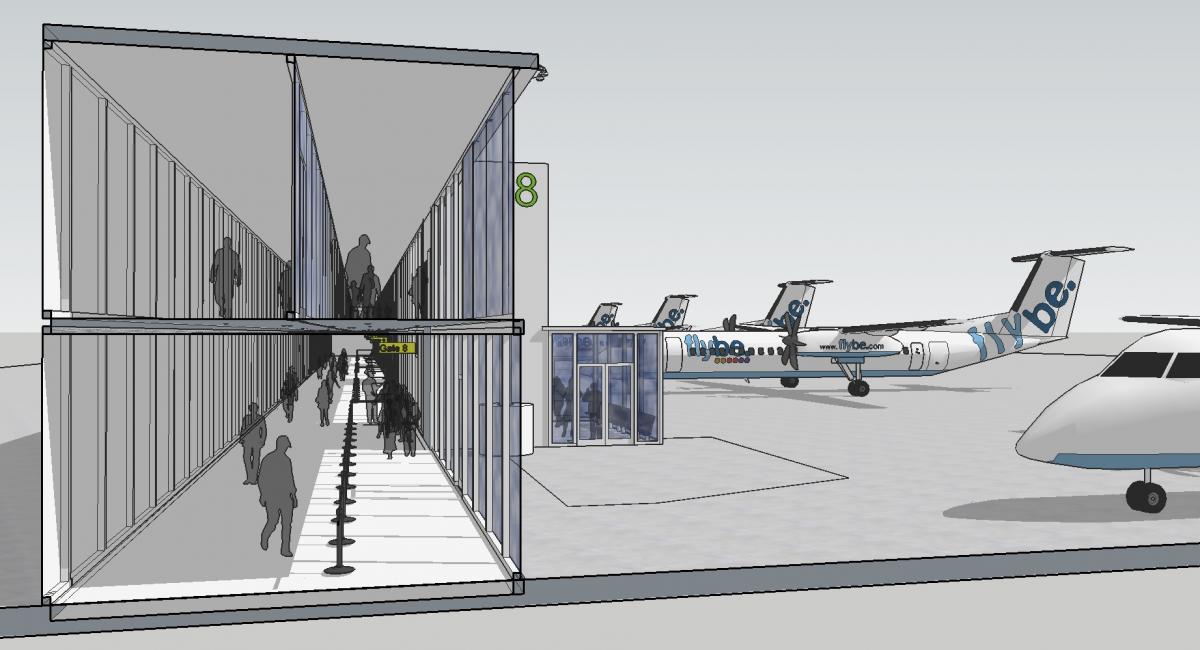

What Bournemouth does have is good terminal facilities, built by previous owner Manchester Airports Group – and a large runway that can take the jets that can’t use Southampton.

“Bournemouth can reach places that Southampton can only dream of reaching,” he said – and even long-haul flights are technically possible.

Southampton currently flies to 41 destinations, several of them in the UK, but it says the demand is there to fly short-haul to mainland Europe.

“The cities of Southampton, Portsmouth, Poole and Bournemouth are especially large catchment areas for passengers,” its new master plan says.

“The airport is popular with passengers because of its ease of access, small scale and its friendly and personal service. Southampton Airport has been designed specifically as a regional airport, providing short haul air links to Western Europe, large UK cities, and the Channel Islands. It is anticipated that these destinations will remain dominant, although aircraft engine technology developments may mean that the aircraft could fly to destinations further afield in the future.

“The airport also has links to some key hub airports such as Amsterdam and Paris which enable easy long-haul connections worldwide.”

Bournemouth Airport’s new owners agree with their Southampton counterparts that there is unmet demand for flights to Europe – but argue that Bournemouth is already geared up for it, with the facilities in place that Southampton is aspiring to.

Andrew Bell, chief executive of RCA, said: “Southampton Airport’s consultation raises the profile of the south and south west aviation market as one that is under-served and has potential to grow – something we at Bournemouth Airport and RCA firmly believe is the case and importantly, that the key lies in making use of existing capacity to satisfy that market.

“The only airport that can meet the needs of the market right now is Bournemouth – it has the runway length, terminal and passenger facilities required in place today and is therefore best placed to meet the demands of the wider region.

“Indeed, Bournemouth is already home to successful operations with Ryanair, TUI and others to European and transatlantic destinations, not to mention significant aviation maintenance businesses which support commercial passenger operations with capacity to accommodate more of this activity in future on the aviation business park.

“Not surprisingly our focus at Bournemouth Airport is on delivering the connectivity the region needs today using our existing airport infrastructure. We strongly believe Bournemouth Airport is best placed to do this and will be successful.”

The process of signing up airlines to new routes takes time, so it is unsurprising that Bournemouth’s new owners have not yet announced new routes.

But a spokesperson told the Daily Echo: “Our ambition is to double the passenger numbers in the next five years.”

Previous managements had expansion goals which did not come to fruition, Derek Robbins pointed out, with several airlines starting routes only to drop them.

But he acknowledged the capacity is there if RCA can convince airlines of the business case.

“Bournemouth can go out and carry one million passengers next year – but they’ve got to persuade the airlines to come to Bournemouth and to fly,” he said.

Fact file: Southampton Airport

SOUTHAMPTON Airport currently has 10 airlines and tour operators flying to 41 destinations in 14 countries

Its most popular destinations in 2017 were Edinburgh, Manchester, Amsterdam, Schiphol, Glasgow, Jersey, Guernsey, Dublin, Belfast City, Newcastle and Paris.

It has identified 15 destinations for which there is particularly strong demand, but which are unserved. They are: Barcelona, Milan, Rome, Stockholm, Frankfurt, Madrid, Berlin, Copenhagen, Venice and Prague.

Demand for those places from Southampton’s catchment area is around two million passengers a year, it says.

Plane movements would rise form the 2017 figure of 39,300 to 53,100 in 2027 and 57,800 by 2037, says its master plan.

The airport, which carried two million passengers last year, says 78 per cent of its passengers are outbound.

It is close to a railway station and the M27 and offers 2,865 parking spaces. The number of spaces would rise to 5,562 by 2027 under the master plan, and to 6,877 by 2037.

Fact file: Bournemouth Airport

BOURNEMOUTH Airport, at Hurn in the borough of Christchurch, was given a £50million overhaul less than a decade ago.

That work, carried out under the ownership of Manchester Airports Group, gave it a new terminal and improvements to the runway, radar, navigation and road access.

Passenger numbers hit just over a million in 2007 and 2008 but then fell sharply.

However, last year, passenger figures rose four per cent to 694,660.

At the end of 2017, the airport was bought by Regional & City Airports – part of the Rigby Group PLC – which owns Coventry, Exeter and Norwich airports and manages several others.

Financial results posted this week show the group’s revenue rose by more than £200million in the year ended on March 31 2018.

The family-owned Rigby Group has a portfolio covering technology, hotels, aviation, real estate and finance. If nothing else, the figure show it is a well-resourced parent for Bournemouth Airport.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel