BUSINESSMAN Andrew Perloff – who is on course to become the next owner of Beales – has insisted: “I’m not an asset stripper.”

Mr Perloff spoke to the Daily Echo after the board of Beales agreed his £1.2m offer for the business despite branding it ‘disappointing’.

“I do like real assets – but I’m in it to improve the trading situation,” he said.

The announcement that the board had agreed Mr Perloff’s bid prompted fears for the future of the business as it is now.

But Mr Perloff, a property magnate and Ukip donor, said his offer was a “rescue deal” for the company. He insisted he would not be laying waste to the department store chain.

“We’re going to do a review of the whole business when we get in full control,” he said.

“We’ve seen the management’s existing plan and we’re going to partially work on that and have a look to see which stores maybe unviable.

“I think it’s very few. It may be that one or two out of 29 are not viable; we don’t know the number. It may be that there are none we have to look at.”

The offer to shareholders from Mr Perloff’s company English Rose last week was for 6p a share – 48 per cent less than they were trading for the previous Friday.

But although the deal was described as cut-price, Mr Perloff points out that he has spent millions to get to this point. He and his family control almost 30 per cent of the equity. They have also taken over a loan on which Beales owes £1m, acquired 7m of the 8m preference shares and bought the freehold to 11 shops.

“They were bought on the open market in a competitive way with other people after them,” he said.

“We have all that invested in our interests to make a success of it.”

The freehold of the Bournemouth store no longer belongs to Beale PLC.

“They must have sold that many years ago,” said Mr Perloff.

He said the company was having difficulties because of the debt it acquired when it bought 19 department stores from the Anglia Regional Co-Operative Society (ARCS) in 2011.

“If you take on debt, you have to repay it sometimes. We are providing extra money with their bank which will help them along the way,” he said.

He said the chain needed “working capital and also expansion capital”.

There had been predictions that a new owner would have no sentimental attachment to the history of Beales, which was founded in Bournemouth in 1886.

But Mr Perloff said: “I’m very sentimental about long-living business. I believe we should do what we can to keep them, they’ve a goodwill element that you can’t really value.”

He said he liked Bournemouth and had been enjoying it as a visitor for 50 years. He stressed that the terms of employment for staff would not be affected by the takeover.

He said there would “not be many” store closures after the review. “It won’t involve many redundancies, I wouldn’t have thought, and certainly it will be some time in the future and it will be better than otherwise.

“We’re not nervous people but banks are nervous people.”

History of the town’s flagship store

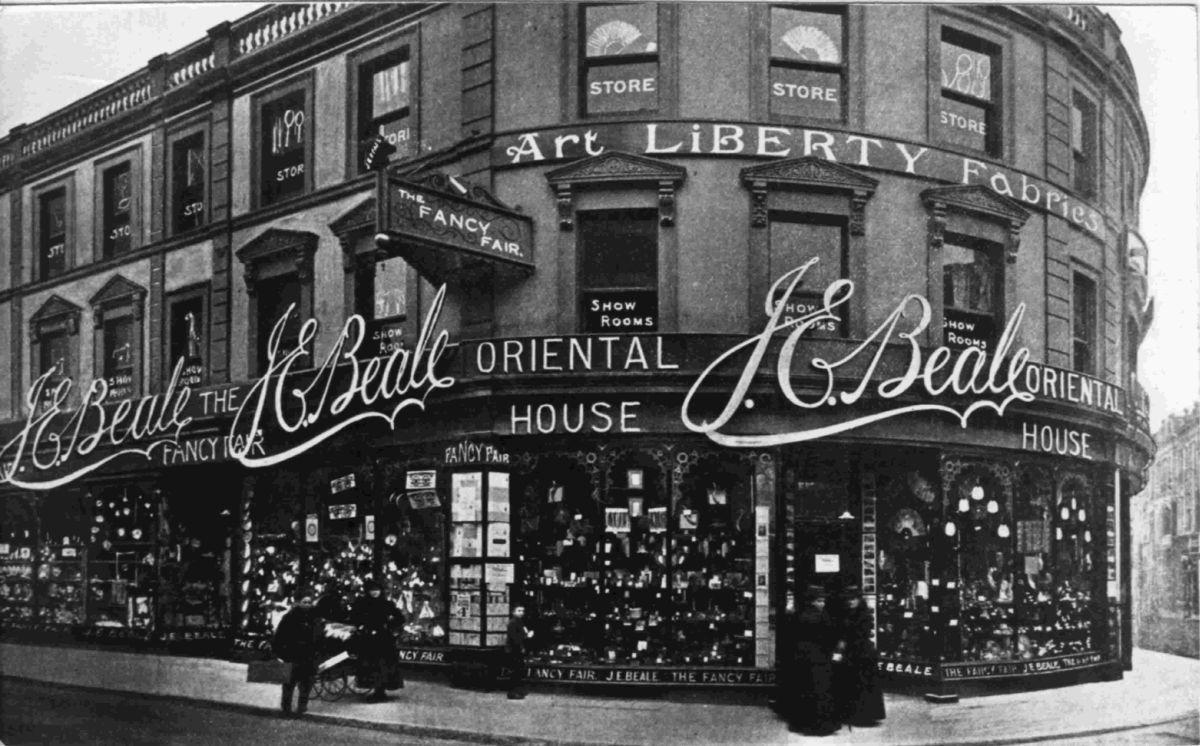

THE flagship store of the Beales chain still stands on the same site where John Elmes Beale opened JE Beale Fancy Fair and Oriental House in 1881.

He later bought the Commercial Road draper’s shop of his friend Mr Okey and turned it into Bealesons.

In 1902, JE Beale was the first of three Beales to become mayor of Bournemouth. Between 1900 and 1987, there was always at least one Beale on Bournemouth council.

The Bournemouth store took a direct hit from a Luftwafe bomber in 1943 and was rebuilt after the war.

In the late 1960s, Beales began an expansion programme that began in Poole and involved opening or acquiring stores across the south. Beale PLC floated on the Stock Exchange in 1995 and bought more stores. But in 2004, it announced a “major drop in profits” in Bournemouth, blaming the opening of Castlepoint.

The surprise decision to buy 19 stores from Anglia Regional Co-operative Society (ARCS) in 2011 was hailed as securing the chain’s future, but it also involved taking on a large debt. In 2013, Beale PLC revealed a loss of almost £6m and refinanced its debts.

Unprofitable stores were closed and the new chief executive, Michael Hitchcock, hailed a “turnaround”, later saying the “blood, sweat and tears” were starting to show results.

Shake-up

THE takeover bid for Beales would see the PLC returned to private hands.

Chairman William Tuffy and Catherine Norgate-Hart would resign as non-executive directors, while chief executive Michael Hitchcock and trading director Tony Richards would remain.

Stuart Lyons would become non-executive chairman, with Andrew Perloff and Simon Peters as non-executive directors.

Mr Peters previously represented Mr Perloff’s company Panther Securities’ on the board until he was ejected last summer.

That prompted an angry response from Mr Perloff, who said at the time: “I have long held the view that: 1) It is foolish to upset your landlord. 2) It is foolish to upset those that provide you with finance. 3) It is foolish for a quoted company to upset its largest shareholder. 4) It is foolish to sack a director who is knowledgeable, well connected and who does not charge a salary or any expenses.

“In one fell swoop Beales has managed all of these, which must be some type of record. It is hard to understand their logic.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel